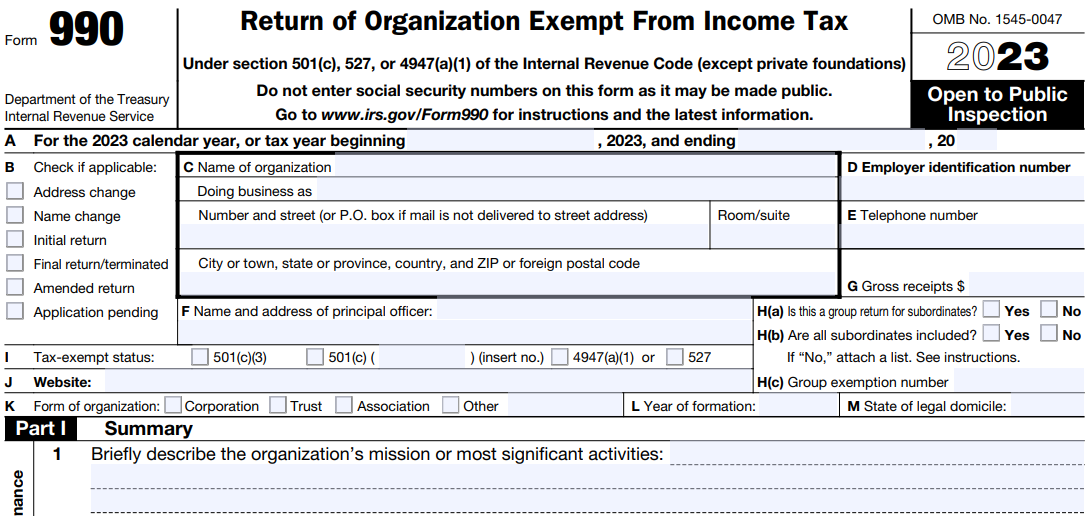

Form 990 For Nonprofits & Tax-Exempt Organizations - An Overview

Tax-exempt organizations, nonexempt charitable trusts, and section 527 political organizations file 990 forms to provide the IRS with the information required by section 6033. 990 Forms varies based on the Organization gross receipts & total assets.

Form 990-N

(e-Postcard)

Filed by organizations with gross receipts less than or equal to $50,000.

Form 990-EZ

(Short Form)

Filed by organizations with gross receipts less than $200,000 and total assets less than $500,000.

Form 990

(Long Form)

Filed by organizations with gross receipts more than or equal to $200,000 or total assets more than or equal to $500,000.

Form 990-PF

(Private Foundation)

Filed by organizations that are exempt and taxable Private Foundations as well as Non-Exempt Charitable Trusts which the IRS considers as private foundations.

Avoid the hassle of paper filing & E-File your 990 tax return easily from a brand you trust.

Start E-Filing NowForm 990 Schedules

IRS requires additional information about nonprofits & tax-exempt organizations while filing form 990, and this can be achieved through Form 990.

The following schedules are part of Form 990.

| Schedule A | Public Charity Status and Public Support |

| Schedule B | Schedule of Contributors |

| Schedule C | Political Campaign and Lobbying Activities |

| Schedule D | Supplemental Financial Statements |

| Schedule E | Schools |

| Schedule F | Statement of Activities Outside the United States |

| Schedule G | Supplemental Information Regarding Fundraising or Gaming Activities |

| Schedule H | Hospitals |

| Schedule I | Grants and Other Assistance to Organizations, Governments, and Individuals in the U.S. |

| Schedule J | Compensation Information |

| Schedule K | Supplemental Information on Tax-Exempt Bonds |

| Schedule L | Transactions with Interested Persons |

| Schedule M | Noncash Contributions |

| Schedule N | Liquidation, Termination, Dissolution, or Significant Disposition of Assets |

| Schedule O | Supplemental Information of Form 990 |

| Schedule R | Related Organizations and Unrelated Partnerships |

When you choose to file your Form 990 with our software, the required schedules will be generated automatically and for FREE.

Start E-Filing Now

About form990.net - A Simplified Cloud-Based Software for

Nonprofit & Tax-Exempt Organization

Form990.net simplifies 990 online filing by offering a user-friendly e-filing experience to complete their tax returns without any hassle. Our Software provides an interview-style filing process and helpful tips throughout the entire process.

Reduce your stress from tax season with these time-efficient features:

Secure IRS 990 Filing

File 990 uses a high level of security to ensure all your organization information is kept safe while filing your 990 forms electronically. As an authorized IRS e-filer, you can be assured that your 990 return will be submitted securely to the IRS.

Free 990 Schedules

We'll autogenerate the appropriate Schedules for your 990, 990-EZ, 990-PF Forms, based on the data you provided through our step by step interview style process.

Never file your 990 late

We’ll save your fiscal period and send you a reminder when it’s time to file next year’s 990 forms.

Easy Filing for your 990 Forms

Just answer a series of simple questions, and we’ll take care of the rest as you complete your 990. Also, you can upload all your income & expense data to complete your form easily.

Manage Reviewers and Approvers

Invite board members or other key officers to review and verify your completed 990 return before transmitting.

Manage Additional Users

Adding members in your organization and give them access to manage your returns. When users are granted access to edit, they can be permitted to pay for the 990 returns, and transmit directly to the IRS.

How to File Form 990 with our Software

Follow these steps to complete your 990 Forms:

Add Organization Details

Search for your EIN, and our system will import your organization’s IRS data or enter your organization’s details manually.

Choose Tax Year

Tax990 supports filing for the current and previous tax year. Simply select the tax year and form you need, then proceed.

Enter Form Data

We provide both Form-based and Interview-style filing options, choose your preferred method for entering form information.

Review your Form Summary

After completing the form, review the summary. Invite key members of the organization to review and approve the return as needed.

Transmit it to the IRS

After thoroughly reviewing the return, transmit it to the IRS. The Tax990 system will provide IRS status updates via email and text.

What other features of our 990 Software make you more comfortable

Amended Return

If you find any corrections after submitting the 990 returns with the IRS, you can quickly correct & retransmit at a small fee with our software.

Form 990 IRS Status

You will receive the mail in a few days regarding your 990 Form filing status.

Retransmit Your Rejected Returns for FREE

If your Form gets rejected for any reason, we will help you to find, fix the errors & retransmit for FREE with our Software.

Our US Based support team helps you at any time during or after your filing. Contact our Support team through email or phone to get instant help.

Automatic Tax Extension for 990 Forms

Tax-Exempt organizations and private foundations can extend their 990 filing deadline by filing an Extension Form 8868. The 8868 form provides you an automatic 6-month extension of time to file 990 forms with no explanation needed.

Start E-Filing Now990 Filing Pricing with form990.net

| Form 990-N | Form 990-EZ | Form 990 | Form 990-PF | Form 8868 |

|---|---|---|---|---|

| $19.90 per return |

$99.90 per return |

$199.90 per return |

$169.90 per return |

$14.90 per return |